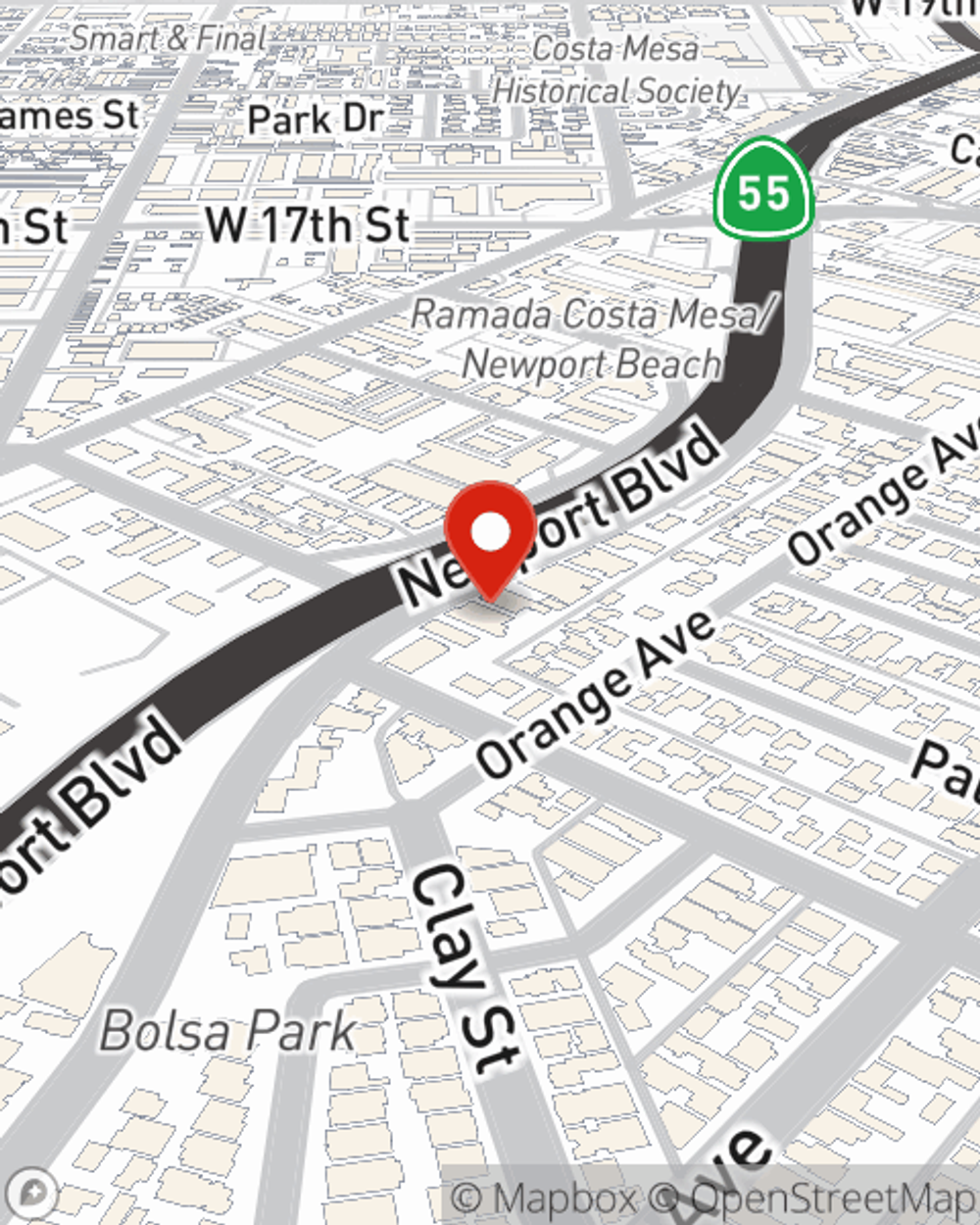

Life Insurance in and around Costa Mesa

Get insured for what matters to you

Now is a good time to think about Life insurance

Would you like to create a personalized life quote?

- Costa Mesa

- Orange County

- Nevada

- Arizona

- Newport Beach

- Irvine

- Clark County

- Douglas County

- Henderson

- Washoe County

- Maricopa County

- Greenlee County

- Pinal County

- Los Angeles County

It's Time To Think Life Insurance

When facing the loss of a family member or your spouse, grief can be overwhelming. Regular day-to-day life halts as you prepare for arrange for burial funeral services, and try to move forward without your loved one.

Get insured for what matters to you

Now is a good time to think about Life insurance

State Farm Can Help You Rest Easy

Having the right life insurance coverage can help loss be a bit less debilitating for your family and provide space to grieve. It can also help cover current and future needs like grocery bills, utility bills and your funeral costs.

Don’t let worries about your future stress you out. Visit State Farm Agent Shahin Chear today and find out the advantages of State Farm life insurance.

Have More Questions About Life Insurance?

Call Shahin at (949) 553-1115 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

Shahin Chear

State Farm® Insurance AgentSimple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.